Business & Leadership

Finance

Government & Policy

Investment Banking

Investment Management

Investment Sales

Market Trends

Research

Servicing

Technology

Valuations

W&D Community

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Thank you! Your submission has been received.

Oops! Something went wrong while submitting the form.

Thank you! Your submission has been received.

Oops! Something went wrong while submitting the form.

Technology

W&D Community

Valuations

Government & Policy

Servicing

Research

Investment Sales

Market Trends

Business & Leadership

Investment Management

Finance

Investment Banking

News & Events

Find out what we’re doing by regularly visiting our news & events pages.

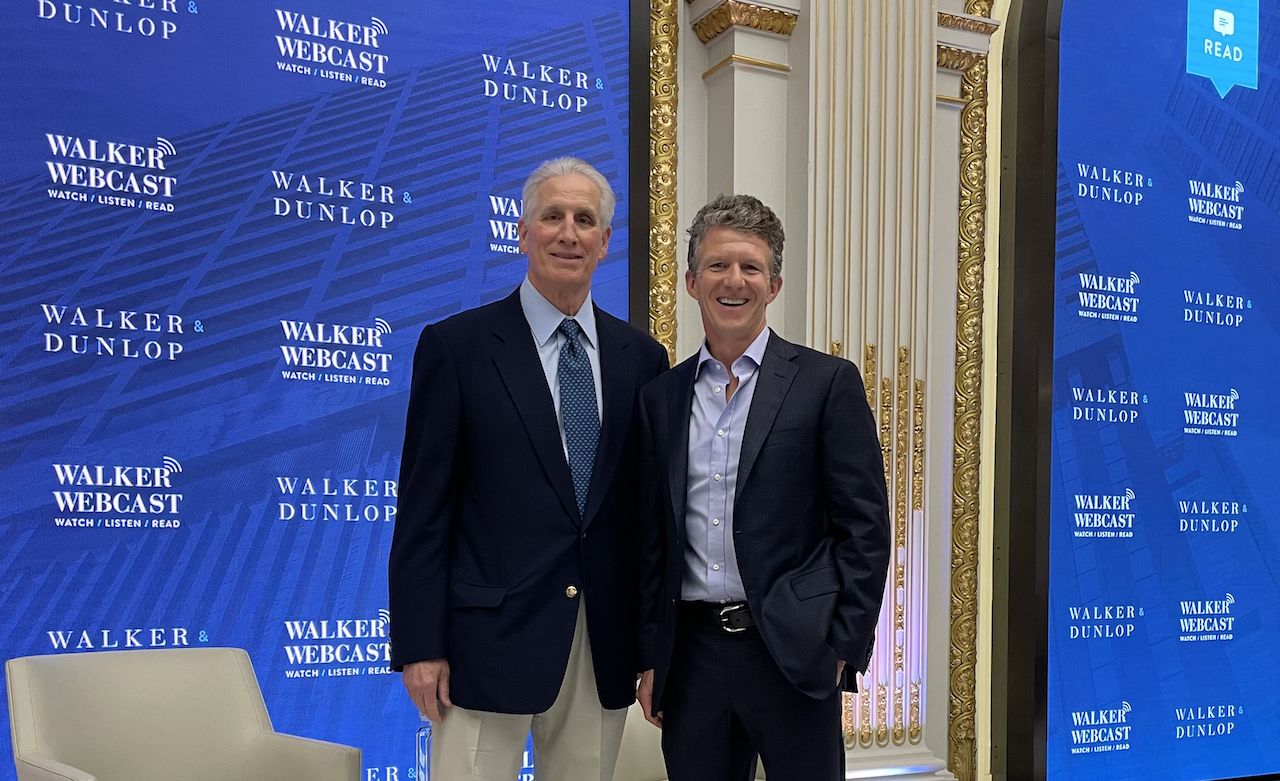

Walker Webcast

Gain insight on leadership, business, the economy, commercial real estate, and more.