The state of commercial real estate constantly changes, but W&D expert Kris Mikkelsen keeps a close eye on what’s happening in the markets. Kris is the Executive Vice President of Investment Sales at Walker & Dunlop. He helped W&D grow our investment sales from a boutique practice to a national platform that transacts with some of the country’s most prominent investors.

With over $50 billion in transactions across 500 clients over the past three years, Kris recently shared some current CRE insights on the Walker Webcast and discussed where investors should focus next.

The impact of CPI and market sentiment

During the webcast, Ivy Zelman called attention to a disappointing CPI print, noting that the Feds likely lack the real-time data needed to make more realistic predictions. According to Kris, the Fed’s access to this data is nearly within reach.

“We're one or two third-party data subscriptions away from the Fed having a better indicator about where rents are going versus the lagging look they use. Regardless of what the CPI print indicates, if there’s something you need to do in terms of a capital transaction over the next 18 months, sooner is better than later. There's real scarcity in the market right now.”

Market sentiment hasn’t changed as a result of one CPI print. “We got a Fed pivot in November and rate relief in December. I think some forgot the pathway to normalcy could be paved with a few speed bumps. And yesterday (February 20, 2024) we caught a speed bump.”

Understanding the bid-ask spread in multifamily properties

Regarding the bid-ask spread on multifamily properties and buyers and sellers, one possibility is that higher rates flush out some of the people who were waiting for rates to fall; instead, we have received some relief in rates, and as a result, the ask has gone up while most bids have remained static. This leads to a consistent bid-ask spread that isn’t being closed, resulting in slow transaction volumes.

Kris illustrates the size of the bid-ask spread:

“In 2023, we took the same amount of product to the market as we did in ‘21 and ‘22. So, extraordinarily active years took a similar amount of product to market in ‘23. Only about 45 percent of the product we took to market got to the point where it was awarded to a buyer. Of the 45 percent that we awarded to buyers, about 85 percent of that either closed or is still under agreement.”

November’s rate relief somewhat readjusted the seller’s expectations. The bid-ask spread for certain assets has certainly widened since then. Many sellers think we’re reverting to the mean as quickly as possible. The equity being deployed today is more aggressive as there is a scarcity of product in the market.

The role of open-ended fund capital in the market

Kris receives many questions about when the open-ended capital fund will be back in the market. This collection of open-ended funds comprises the ODCE Index, tracked by NCREIF. As Kris explains:

“There are about 2,500 multifamily assets inside these funds, all of which are appraised quarterly. So when we hear conversations about where various funds are carrying their assets, what we're referring to is that light blue line on the bottom of this graph, which is the average of the appraised cap rates on a quarterly basis.”

“That appraised cap rate has been significantly lower than where the private market is transacting since the beginning of the hiking cycle. In the fourth quarter, we were encouraged that most of the funds that comprise the index took further write-downs on their multi to try to bring it more in line with where the market is transacting. Their ability to onboard new capital becomes much easier when buying into a basket of assets valued much closer to the market.”

Kris predicts it may be well into 2025 before these carry values get right-sized.

The shift in investment strategies

When looking at $250 billion in capital waiting to get into the market, Kris notes about 90 percent of it is geared to generate value-added and opportunistic returns. It’s an extremely challenging task to get to a price that a seller will take.

“We have seen, in some corners of the market, groups that have the $80 billion of value add dry powder saying, ‘Look, the Fed has pivoted. I’m confident the development pipeline has turned off. We will get on the other side of the supply wave. I need to start moving my capital again. I'm going to do that in assets where I have a strong level of conviction, and I want to own it long-term.’”

Six months ago, Kris shared that if they’d asked these groups to commit to a transaction, they would have required opportunistic returns to commit capital amidst the uncertainty. Today, they’re more eager to pursue assets they have a higher level of conviction around.

Kris has seen pricing improve in this space because these investors want to pursue similar asset profiles. The trades have grown more crowded and that corner of the market has gotten more expensive in the last 60 days.

“These buyers are behaving as though they are feeling the weight of their capital once again,” he notes.

Development economics and construction financing

Development economics are upside down, and the pace of new construction starts is off substantially. Among the biggest challenges is the ability to justify development yields.

“I’d say, at minimum, you need about 100 basis points worth of additional development return before you can attract capital. For multifamily, you need to see return on cost figures closer to mid-sixes, but middle-ground development opportunities are closer to the mid-fives. So to close the gap, you need 20 percent cost relief or 17-18 percent NOI improvement. It's hard to look at rents for top-line growth and expense pressure, particularly around taxes and insurance make it difficult to see NOI improvement closing that gap.”

The 'haves' and 'have-nots' in today's market

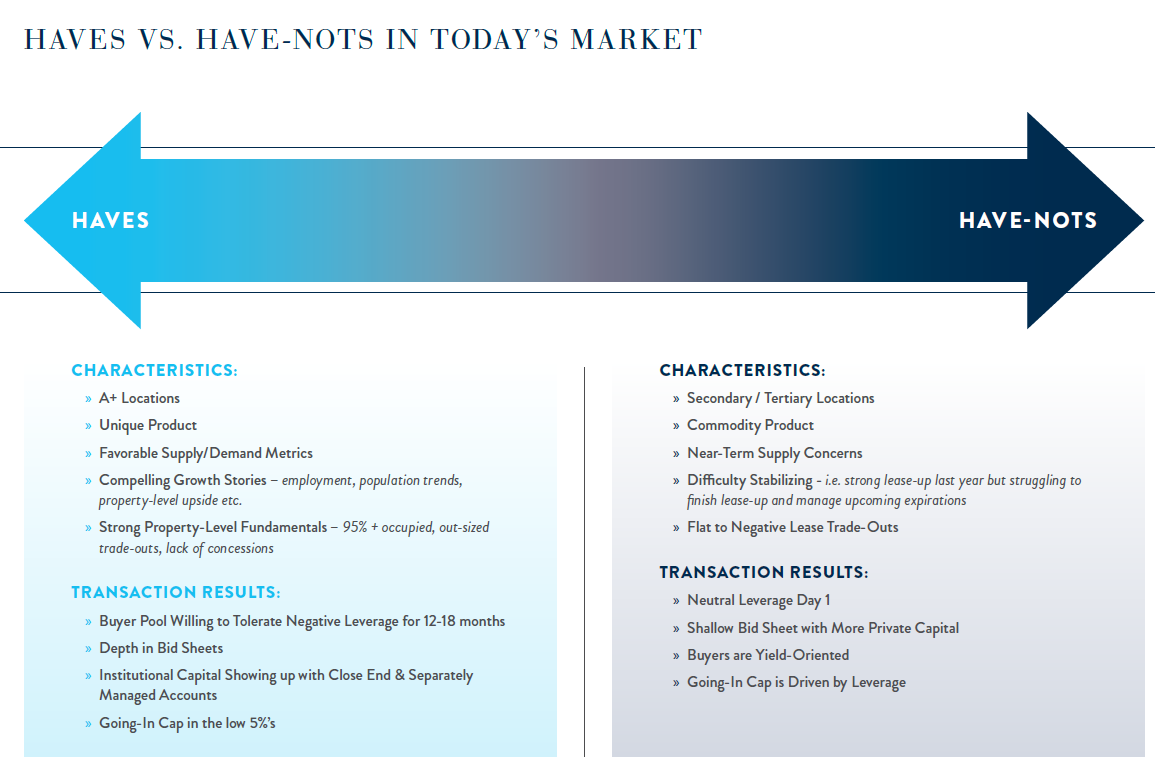

Markets tend to get a broad brush, and having one-size-fits-all takeaways is difficult in CRE. Kris’ team summarizes the current state of the market by dividing the spectrum into the “haves” and “have-nots.”

“With the ‘haves,’ you’ve got good locations, differentiated products, and favorable supply and demand metrics in the surroundings. You've got good, clean operating fundamentals. We’re seeing depth in these bid sheets and a willingness to absorb 18 to 24 months' worth of negative leverage. Yields are in the upper fours to the low 5 percent range.

“With the ‘have-nots,’ you have operationally broken assets that have been extraordinarily starved for capital, some for a period over the last 24 months, others for as long as a decade. Where you fall on this ‘Have to Have Not’ spectrum is ultimately going to dictate value.”

What’s next for CRE in 2024?

Kris advises investors to focus on broader themes of in-migration, business-friendly climates, high-quality product and locations, and capitalize on the very attractive cost basis relative to replacement cost versus attempting to predict where rates are heading and where they will and will not provide relief. Monitoring the bigger picture and not relying on a single report like the recent CPI print will be key to making the right investments in the current market.

Hear the full conversation with Kris on the Walker Webcast and connect with Kris to discuss your next project.

News & Events

Find out what we’re doing by regularly visiting our news & events page.

Walker Webcast

Gain insight on leadership, business, the economy, commercial real estate, and more.